From law enforcement to consumer advocates, the FINRA Foundation has trained thousands to detect, prevent, and respond to financial fraud. Moreover, the Foundation and its partners are at the forefront of research to better understand the prevalence and types of financial frauds committed in the U.S., behavioral and neurological risk factors, and the effectiveness of interventions aimed at protecting consumers.

Resources for Fraud Fighters

Research on Understanding and Combating Financial Fraud

FINRA Foundation research examines factors that contribute to fraud victimization and scam susceptibility as well as interventions and preventative measures aimed at protecting consumers.

Assisting Victims of Fraud

In collaboration with many partners, the FINRA Foundation has developed resources to help consumer advocates and family members assist fraud victims. Explore our training options for advocates and peer support programs for victims, and learn how to mitigate the social and emotional impacts of the experience.

Training for Law Enforcement

Since 2012, the FINRA Foundation has partnered with the National White Collar Crime Center (NW3C) to deliver the Targeting Investment Fraud (TIF) training to law enforcement officers, investigators, and prosecutors. Topics include what constitutes a security, hallmarks of investment fraud schemes, investigative strategies for working with victims and perpetrators, and fraud prevention resources. Visit NW3C.org for the list of available TIF classes.

Free Publications

FINRA and the FINRA Foundation offer a variety of brochures, publications and handout materials for distribution in your community. Visit the Free Publications Portal to order items by mail or visit FINRA.org to download some of our most popular publications in PDF.

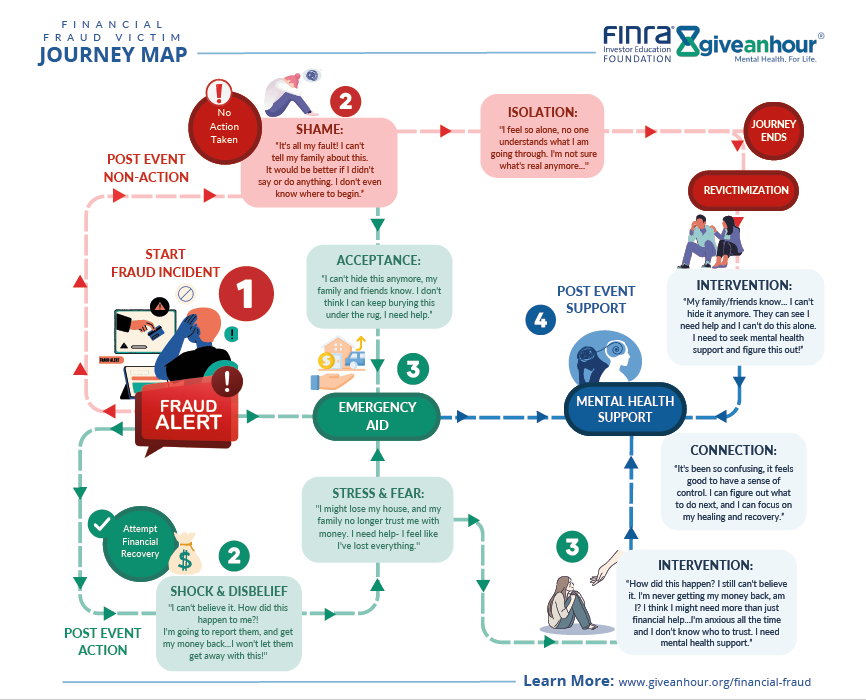

Financial Fraud Victim Journey Map

The FINRA Foundation and Give an Hour documented the emotional journey that many financial fraud victims experience. Download the Financial Fraud Victim Journey Map to learn more about the social and emotional impacts that often accompany fraud victimization and the spectrum of mental health support tools offered through this partnership, including provider trainings and peer support programs for victims.