The FINRA Investor Education Foundation is pleased to make FICO® credit scores—and the educational information and tools in the FICO Standard product—available free of charge to active duty service members and their spouses who could benefit from its use. To ensure the tool is used by those who need it most, we are distributing access primarily through military financial educators and counselors, who have personalized Financial Educator Codes that unlock the system.

The system involves two steps:

- Registration with the FINRA Foundation on finrafoundation.org/creditscore-register for free access to the FICO Standard product; and,

- Creation of a personal profile on myFICO.com® so clients can obtain their actual FICO credit scores and reports.

On This Page:

Step 1: Register Your Client

- Ascertain whether your client is ready to obtain their score successfully. Step 2 requires clients to create a profile on myFICO.com. Because profile creation involves entering a valid Social Security Number and responding correctly to "challenge questions" that verify identity (such as confirmation of mortgage carrier or recent payment amounts), your client might need to access financial records before registering.

- Go to finrafoundation.org/creditscore, and click on the following button:

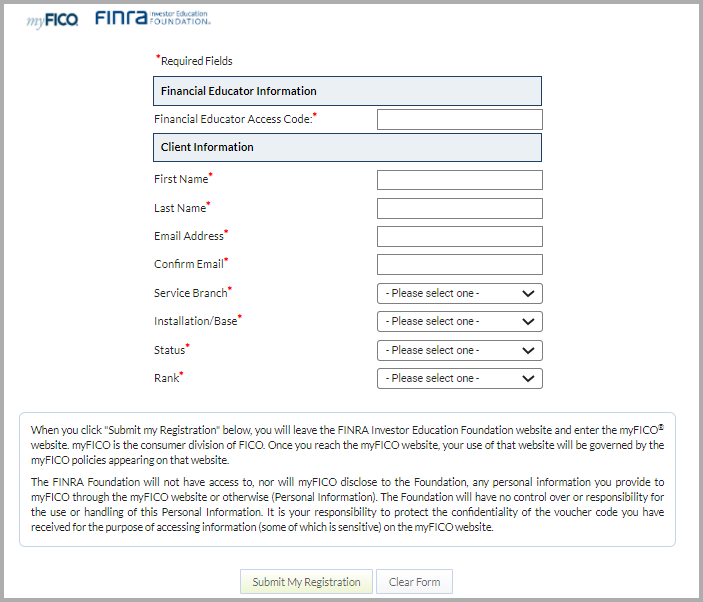

- Enter your personal Financial Educator Code under "Financial Educator Information" to unlock the system:

You or your client should then fill in the rest of the requested information. Your client may be required to furnish a valid military email address to successfully complete their registration with the FINRA Foundation.

- Press the "Submit my Registration" button.

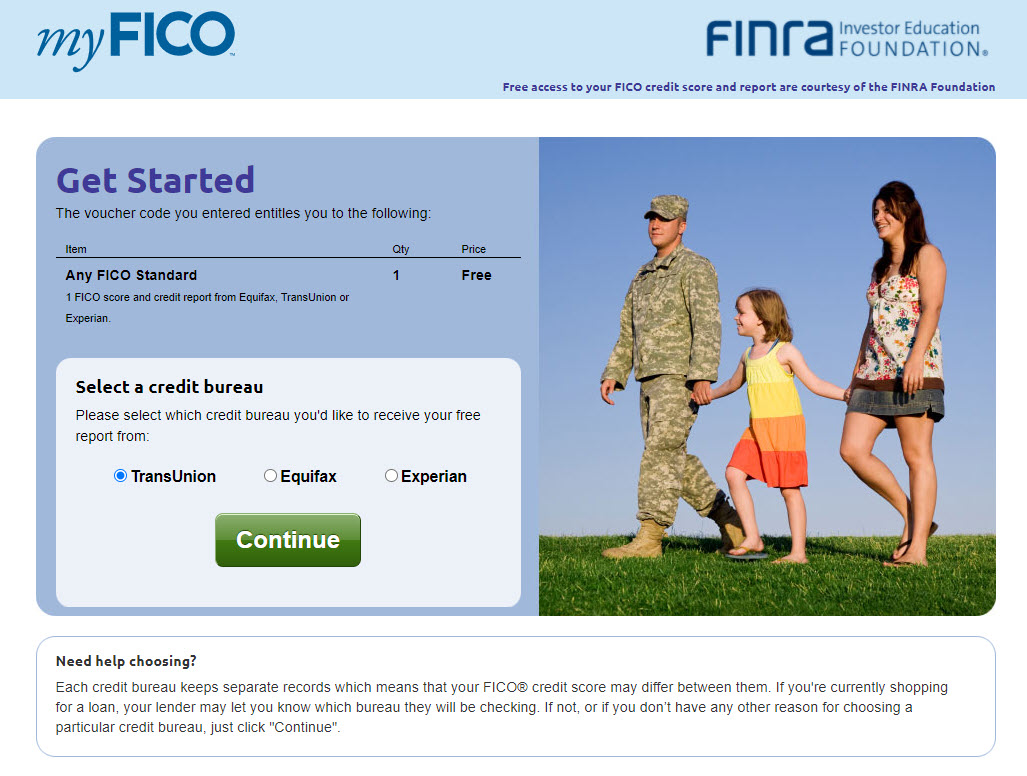

- If successful, the myFICO page where your client can select their desired credit reporting bureau will display. Your client will simultaneously receive a confirming email from CreditScore@finra.org.

-

Proceed to Step 2 as follows:

- If your client is ready to move forward—and is willing to share their personal information and review their FICO score and report with you—select the desired credit bureau.

- If your client wishes to complete the process later (either in private or in a subsequent meeting with you), your client will need to open the confirming email from CreditScore@finra.org and follow the instructions.

Your client (or you and your client) will then see the following screen:

Step 2: Create Profile on myFICO.com to View the FICO Credit Score and Report

At this point, your client should:

- Select the desired credit bureau—TransUnion, Equifax or Experian—to receive a free FICO score and report (only one FICO score and report is permitted per client in this program).

-

Press "Continue" to access the "Create Account" tab on myFICO.com. Clients who have never used myFICO.com before should create a personal profile. Those who have should log in using their existing User ID and Login.

Important

- Clients creating a new profile might need to answer identity confirmation questions, such as confirming their mortgage carrier and amount of monthly payment. Other questions might be asked depending on the individual's credit history and data, and some of this information may be historical. If your client does not know the answers to the questions posed, they may need to call FICO customer support at (800) 848-1133.

- Clients who have an "Active Duty Flag" on their credit files will be required to contact the FICO customer support center at (800) 848-1133 (Monday to Friday, 6:00 a.m. to 6:00 p.m. Pacific Time, or Saturday 7:00 a.m. to 4:00 p.m. Pacific Time) to positively identify themselves before they can obtain their FICO score.

- Clients creating a new profile might need to answer identity confirmation questions, such as confirming their mortgage carrier and amount of monthly payment. Other questions might be asked depending on the individual's credit history and data, and some of this information may be historical. If your client does not know the answers to the questions posed, they may need to call FICO customer support at (800) 848-1133.

- Click "View Your Purchase" to view his or her FICO credit score and report. (Because the FINRA Foundation covers the cost, this report is free of charge to your client.) We encourage clients to review all the tabs of the report, print a copy and take advantage of the tools myFICO offers.

Additional Guidance

- Returning to a report: Your clients may log in to their profiles to view their FICO credit score and report for 30 days from initial registration by:

- Clicking on the link in the myFICO Order Confirmation email; or

- Going to finrafoundation.org/creditscore, clicking on the "Returning Users" button (illustrated below).

Note that the report will be the same one seen on the initial day of registration; it is not updated daily.

- Clicking on the link in the myFICO Order Confirmation email; or

- Soft hit: Credit reports received through this program do not count against the one annual credit report from each of the credit bureaus authorized by law. Also, the inquiry is a "soft hit" and does not count as a credit inquiry that will affect an individual's FICO score.

- Obtaining a report for an active duty service member's spouse: Simply go back to Step 1 to register the spouse and create (or return to) the spouse's profile on myFICO.com.

Key Contact Information

If you need assistance registering service members or spouses on FINRAFoundation.org for their free FICO credit score and analysis, please contact us at [email protected].

For assistance with myFICO.com or obtaining a FICO score, please call the toll-free line for FINRA Foundation users at (800) 848-1133 (Monday to Friday, 6:00 a.m. to 6:00 p.m. Pacific Time, or Saturday 7:00 a.m. to 4:00 p.m. Pacific Time), and a FICO call center specialist will help you.